#Cash raffle tickets for sale license

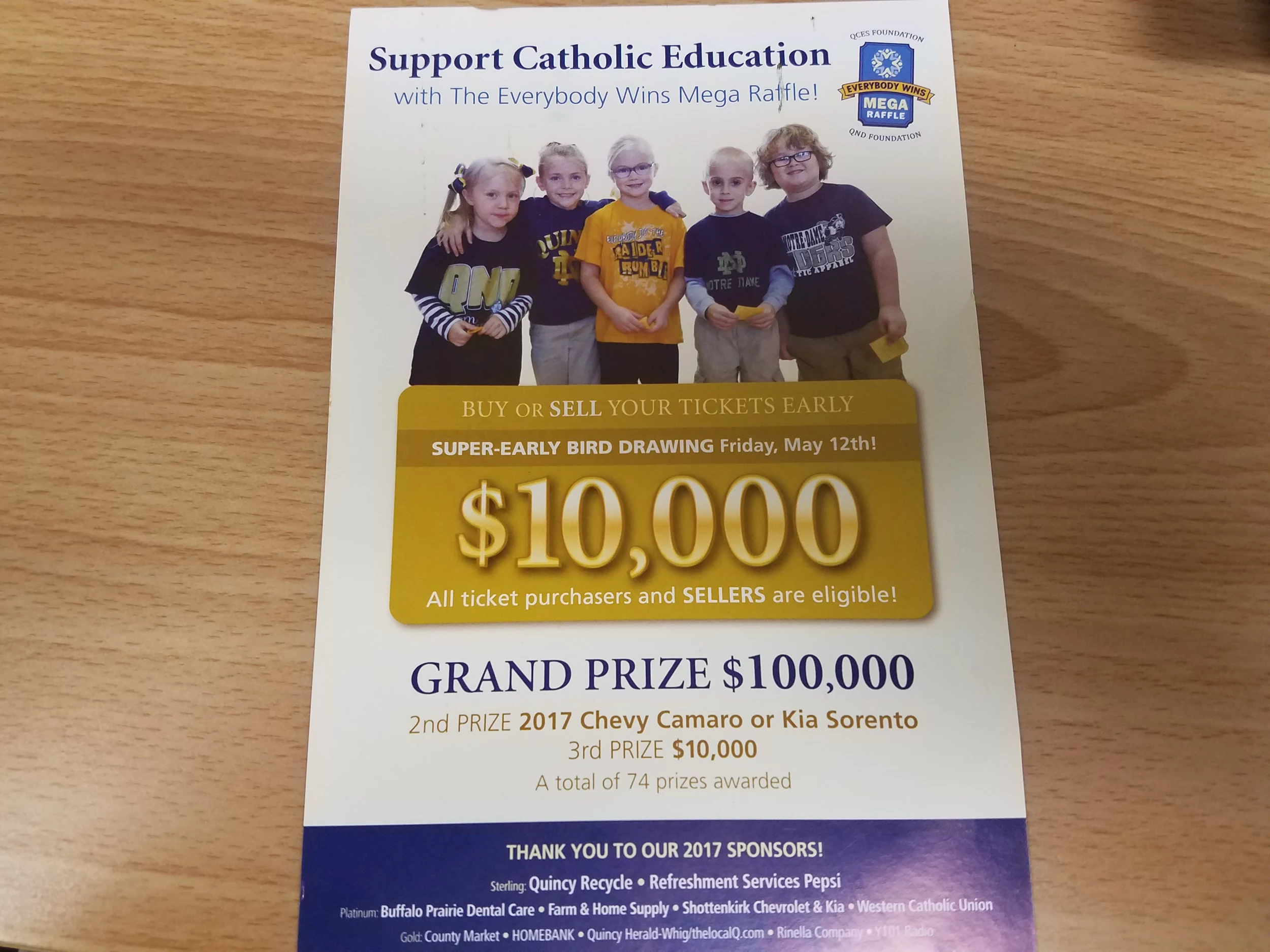

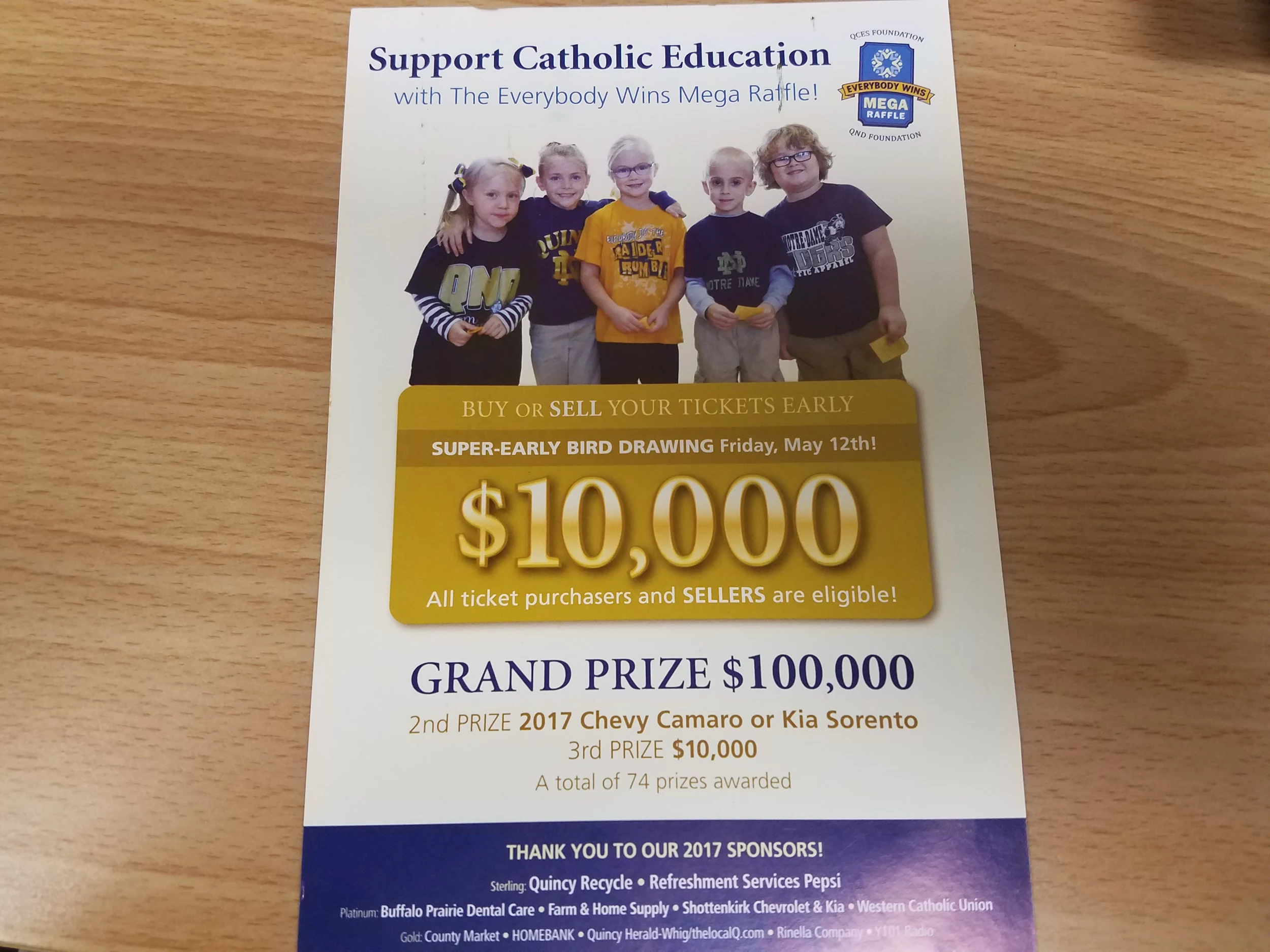

How many raffles you run each year: If you run just one or two raffles each year, check if your state offers a special limited license which has lower fees and less stringent reporting requirements.įor most locales, you need to be a tax-exempt 501(c) organization. Gross proceeds: Raffles exceeding many thousands of dollars in ticket sales may require a special license, or may be totally disallowed. How you sell tickets: Online ticket sales may require a special license with your state, or may be totally disallowed. Retail value of your prizes: Prizes with low retail value may require a less expensive license and relaxed reporting requirements.

Your requirement for a license may depend on: To run a legal raffle, you will most likely need a gaming license.

Publish clear rules specifying methods of entry, the entry deadline, drawing date and other disclaimers pertaining to your sweepstakes. So, award each free entry a number of tickets equal to the average number of tickets purchased by paying participants. Free entries must be given the same chance of winning as donation-based entries.

Many sweepstakes have exclusively online ticket sales to guarantee the free method is presented.

The free method of entry must be presented to the purchaser at the point of sale. Many charity sweepstakes won’t get a single mailed-in entry form because participants understand the purpose is to raise money for a good cause.Īlthough sweepstakes avoid many of the regulations that govern raffles, mind the following: To be certain, the vast majority of sweepstakes entries will be issued after someone makes a cash donation to your cause. As with raffles, check if your municipality has any additional rules that govern sweepstakes, though you’ll generally find a less stringent regulatory environment. Turn a raffle into a sweepstakes by allowing entrants to print and mail an entry form for a free chance to win. Too Much Red Tape? Consider a Sweepstakes

0 kommentar(er)

0 kommentar(er)